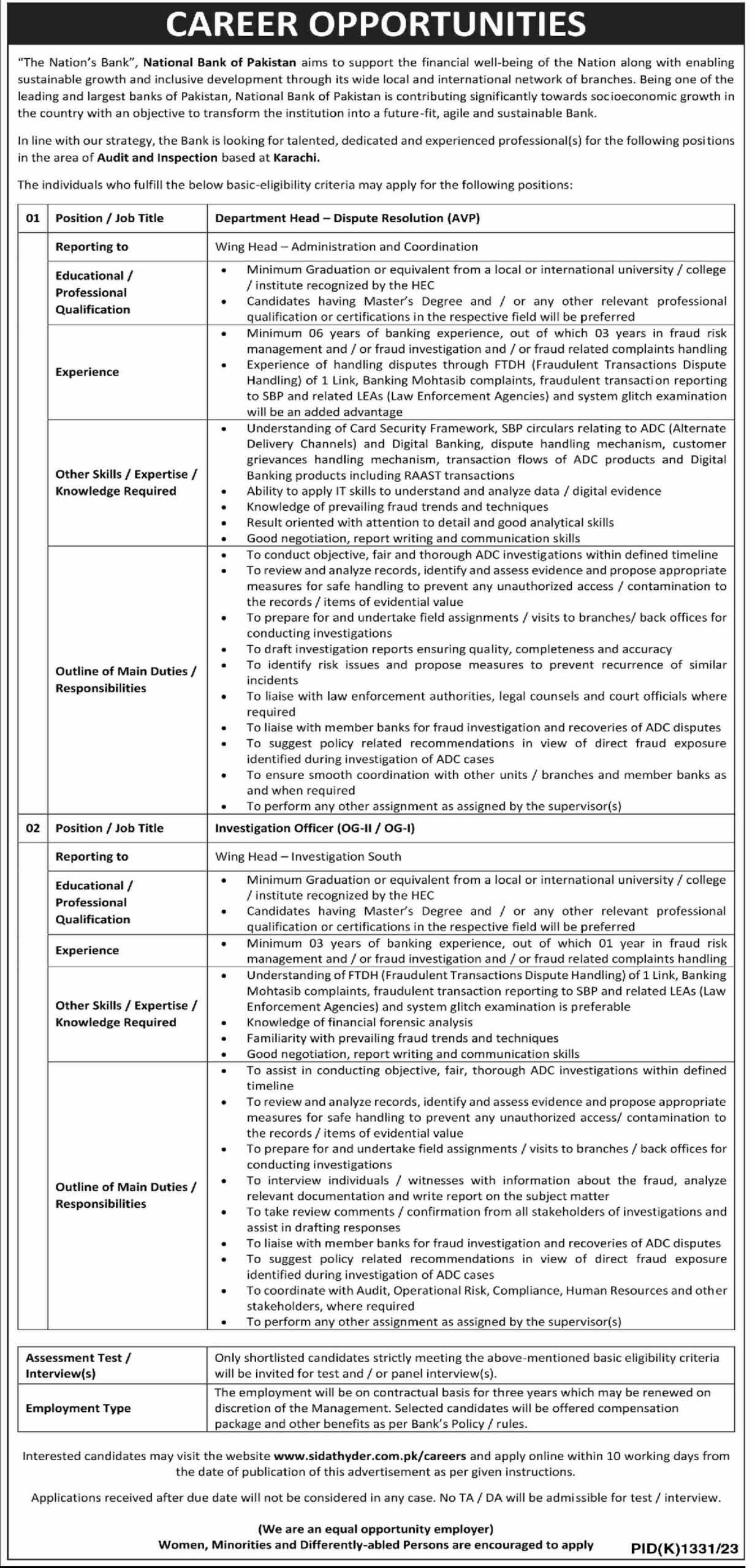

National Bank of Pakistan Jobs Audit and Inspection at Karachi Newspaper Ads – Government Jobs in Sindh Pakistan

“The Nation’s Bank”, National Bank of Pakistan aims to support the financial well-being of the Nation along with enabling

sustainable growth and inclusive development through its wide local and international network of branches. Being one of the

leading and largest banks of Pakistan, National Bank of Pakistan is contributing significantly towards socioeconomic growth in

the country with an objective to transform the institution into a future-fit, agile and sustainable Bank.

In line with our strategy, the Bank is looking for talented, dedicated and experienced professional(s) for the following positions

in the area of Audit and Inspection based at Karachi.

The individuals who fulfill the below basic-eligibility criteria may apply for the following positions:

Educational / e Minimum Graduation or equivalent from a local or international university / college

Professional / institute recognized by the HEC

Qualification e Candidates having Master’s Degree and / or any other relevant professional

qualification or certifications in the respective field will be preferred

e Minimum 06 years of banking experience, out of which 03 years in fraud risk

management and / or fraud investigation and / or fraud related complaints handling

Experience e Experience of handling disputes through FTDH (Fraudulent Transactions Dispute

Handling) of 1 Link, Banking Mohtasib complaints, fraudulent transaction reporting

to SBP and related LEAs (Law Enforcement Agencies) and system glitch examination

will be an added advantage

Understanding of Card Security Framework, SBP circulars relating to ADC (Alternate

Delivery Channels) and Digital Banking, dispute handling mechanism, customer

grievances handling mechanism, transaction flows of ADC products and Digital

Other Skills / Expertise / Banking products including RAAST transactions

Knowledge Required e = Ability to apply IT skills to understand and analyze data / digital evidence

Knowledge of prevailing fraud trends and techniques

Result oriented with attention to detail and good analytical skills

Good negotiation, report writing and communication skills

To conduct objective, fair and thorough ADC investigations within defined timeline

To review and analyze records, identify and assess evidence and propose appropriate

measures for safe handling to prevent any unauthorized access / contamination to

the records / items of evidential value

e To prepare for and undertake field assignments / visits to branches/ back offices for

conducting investigations

e To draft investigation reports ensuring quality, completeness and accuracy

Outline of Main Duties / e To . identify risk issues and propose measures to prevent recurrence of similar

Responsibilities incidents .

e = To liaise with law enforcement authorities, legal counsels and court officials where

required

e To liaise with member banks for fraud investigation and recoveries of ADC disputes

e To suggest policy related recommendations in view of direct fraud exposure

identified during investigation of ADC cases

e To ensure smooth coordination with other units / branches and member banks as

and when required

To perform any other assignment as assigned by the supervisor(s)

Educational / e Minimum Graduation or equivalent from a local or international university / college

Professional / institute recognized by the HEC

Qualification e Candidates having Master’s Degree and / or any other relevant professional

qualification or certifications in the respective field will be preferred

Experience e Minimum 03 years of banking experience, out of which 01 year in fraud risk

. management and / or fraud investigation and / or fraud related complaints handling

e Understanding of FTDH (Fraudulent Transactions Dispute Handling) of 1 Link, Banking

Mohtasib complaints, fraudulent transaction reporting to SBP and related LEAs (Law

Other Skills / Expertise / Enforcement Agencies) and system glitch examination is preferable

Knowledge Required e Knowledge of financial forensic analysis

Familiarity with prevailing fraud trends and techniques

Good negotiation, report writing and communication skills

To assist in conducting objective, fair, thorough ADC investigations within defined

timeline

To review and analyze records, identify and assess evidence and propose appropriate

measures for safe handling to prevent any unauthorized access/ contamination to

the records / items of evidential value

* To prepare for and undertake field assignments / visits to branches / back offices for

conducting investigations

Outline of Main Duties / e To interview individuals / witnesses with information about the fraud, analyze

Responsibilities relevant documentation and write report on the subject matter

To take review comments / confirmation from all stakeholders of investigations and

assist in drafting responses

To liaise with member banks for fraud investigation and recoveries of ADC disputes

To suggest policy related recommendations in view of direct fraud exposure

identified during investigation of ADC cases

To coordinate with Audit, Operational Risk, Compliance, Human Resources and other

stakeholders, where required

e To perform any other assignment as assigned by the supervisor(s)

Assessment Test / Only shortlisted candidates strictly meeting the above-mentioned basic eligibility criteria

Interview(s) will be invited for test and / or panel interview(s).

The employment will be on contractual basis for three years which may be renewed on

Employment Type discretion of the Management. Selected candidates will be offered compensation

package and other benefits as per Bank’s Policy / rules.

Interested candidates may visit the website www.sidathyder.com.pk/careers and apply online within 10 working days from

the date of publication of this advertisement as per given instructions.

Applications received after due date will not be considered in any case. No TA / DA will be admissible for test / interview.

(We are an equal opportunity employer)

Women, Minorities and Differently-abled Persons are encouraged to apply PID(K)1331/23